Facts & Figures

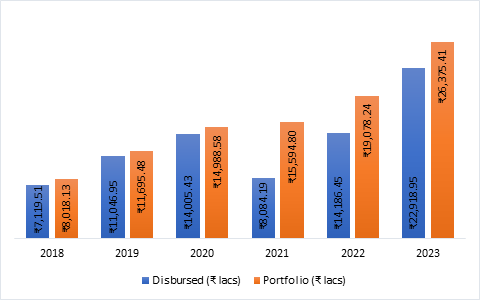

Following are the statistics pertaining to the credit disbursed till date.

Portfolio Reports

| Ratio |

March-2025 |

|---|---|

| Operating Cost Ratio | 7.29% |

| Total Cost Ratio | 19.65% |

| Operating Self Sufficiency | 107.98% |

| Yield on Portfolio | 21.56% |

| Return on Assets | 1.13% |

| Return on Equity | 12.31% |

| Year | Loan Disbursement (Rs. In Lakh) |

Total Portfolio (Rs. In lakh) |

|---|---|---|

| March -2025 | 16727.57 | 24026.81 |

District Wise SHGs and Members

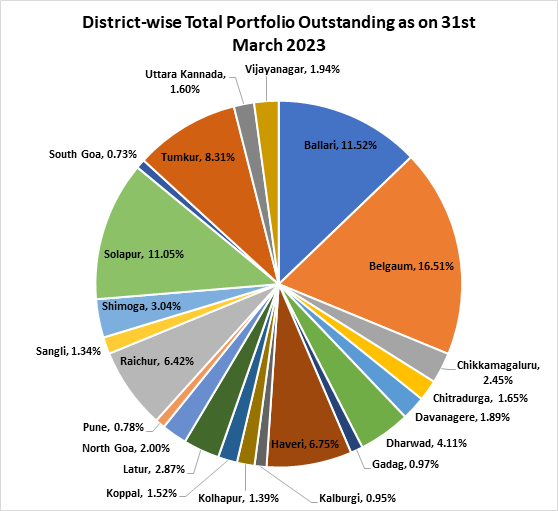

The Total Portfolio district wise details of SHGs formed as on 31st March 2025

| Sl. No. | Districts | No. of SHGs |

|---|---|---|

| 01 | Bagalkot | 232 |

| 02 | Ballari | 851 |

| 03 | Belgaum | 3,863 |

| 04 | Chikkamagaluru | 388 |

| 05 | Chitradurga | 488 |

| 06 | Davanagere | 332 |

| 07 | Dharashiv | 165 |

| 08 | Dharwad | 989 |

| 09 | Gadag | 401 |

| 10 | Haveri | 1,621 |

| 11 | Jogulamba Gadwal | 31 |

| 12 | Kalburgi | 385 |

| 13 | Kolhapur | 561 |

| 14 | Koppal | 307 |

| 15 | Latur | 710 |

| 16 | North Goa | 658 |

| 17 | Pune | 240 |

| 18 | Raichur | 1,131 |

| 19 | Ratnagiri | 38 |

| 20 | Sangli | 342 |

| 21 | Shimoga | 756 |

| 22 | Sindhudurg | 238 |

| 23 | Solapur | 3,435 |

| 24 | South Goa | 214 |

| 25 | Sri Sathya Sai | 29 |

| 26 | Tumkur | 1,508 |

| 27 | Uttara Kannada | 539 |

| 28 | Vijayanagar | 1,297 |

| 29 | Vijayapura | 1,564 |

| 30 | Yadgir | 521 |

| Total | 23,834 | |

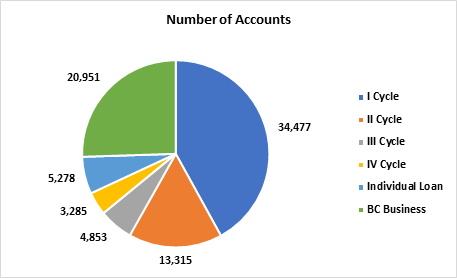

No. of Accounts and OS Bal. as of 31st March 2025 (Total Portfolio)

| Sl. No. | State | Districts | No. of A/c. | OS Balance |

|---|---|---|---|---|

| 01 | Karnataka | Bagalkot | 1,143 | 385 |

| 02 | Karnataka | Ballari | 4,804 | 1,297 |

| 03 | Karnataka | Belgaum | 10,717 | 4,326 |

| 04 | Karnataka | Chikkamagaluru | 949 | 300 |

| 05 | Karnataka | Chitradurga | 1,706 | 576 |

| 06 | Karnataka | Davanagere | 1,117 | 367 |

| 07 | Karnataka | Dharashiv | 693 | 228 |

| 08 | Karnataka | Dharwad | 2,806 | 994 |

| 09 | Karnataka | Gadag | 1,354 | 426 |

| 10 | Karnataka | Haveri | 4,347 | 1,565 |

| 11 | Karnataka | Jogulamba Gadwal | 153 | 69 |

| 12 | Karnataka | Kalburgi | 1,935 | 457 |

| 13 | Karnataka | Kolhapur | 2,083 | 621 |

| 14 | Karnataka | Koppal | 889 | 299 |

| 15 | Maharashtra | Latur | 2,270 | 555 |

| 16 | Goa | North Goa | 2,990 | 955 |

| 17 | Maharashtra | Pune | 1,032 | 257 |

| 18 | Karnataka | Raichur | 3,607 | 1,156 |

| 19 | Maharashtra | Ratnagiri | 198 | 88 |

| 20 | Maharashtra | Sangli | 822 | 172 |

| 21 | Karnataka | Shimoga | 2,131 | 696 |

| 22 | Maharashtra | Sindhudurg | 1,169 | 449 |

| 23 | Maharashtra | Solapur | 11,185 | 3,092 |

| 24 | Goa | South Goa | 823 | 206 |

| 25 | Andhra Pradesh | Sri Sathya Sai | 179 | 82 |

| 26 | Karnataka | Tumkur | 4,190 | 1,385 |

| 27 | Karnataka | Uttara Kannada | 1,799 | 637 |

| 28 | Karnataka | Vijayanagar | 1,251 | 336 |

| 29 | Karnataka | Vijayapura | 5,891 | 1,643 |

| 30 | Karnataka | Yadgir | 1,690 | 406 |

| Total | 75,923 | 24,025 | ||

No. of Accounts and OS Bal. as of 31st March 2025 (Total Portfolio)

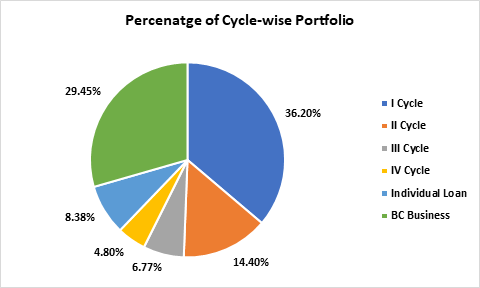

Total Loan Products as of 31st March 2025

| Product | No. of A/c. | Amt. (Lakh) | % |

|---|---|---|---|

| I Cycle | 28,753 | 7,582.44 | 36.64% |

| II Cycle | 17,972 | 5,465.47 | 26.41% |

| III Cycle | 6,266 | 2,189.54 | 10.58% |

| IV Cycle | 4,274 | 1,734.74 | 8.38% |

| Individual Loan | 7,428 | 3,721.51 | 17.98% |

| Owned Portfolio | 64,693 | 20,693.70 | 100% |

| Managed Portfolio | 11,231 | 3,333.10 | 100% |

| Total Portfolio | 75,924 | 24,026.80 | 100% |